To create a corporation, every state requires a Certificate of Incorporation or charter to be filed with the secretary of state. The following information is generally required to be in the Certificate of Incorporation:

The Corporation’s Name

The corporation must choose a name that is not so similar to that of another company in that state that it causes confusion or lends itself to deception. It must also include a term such as “corporation,” “incorporated,” “company,” or “limited” to notify the public that they are dealing with a corporation.

The Corporation’s Statement of Purpose

The incorporators must state in general terms the intended nature of the business. The purpose must, of course, be lawful. An illustration might be “to engage in the sale of office furniture and fixtures.” The purpose should be broad enough to allow for some expansion in the activities of the business as it develops.

The Corporation’s Time Horizon

Most corporations are formed with no specific termination date; they are formed “for perpetuity.” However, it is possible to incorporate for a specific duration, for example, 50 years.

Names and Addresses of the Incorporators

The incorporators must be identified in the articles of incorporation and are liable under the law to attest that all information in the articles of incorporation is correct. Some states require one or more of the incorporators to reside in the state in which the corporation is being created.

Place of Business

The street and mailing addresses of the corporation’s principal office must be listed. For a domestic corporation, this address must be in the state in which incorporation takes place.

Capital Stock Authorization

The articles of incorporation must include the amount and class (or type) of capital stock the corporation wants to be authorized to issue. This is not the number of shares it must issue; a corporation can issue any number of shares up to the total number authorized. This section must also define the different classification of stock and any special rights, preferences, or limits each class has.

Restrictions on Transferring Shares

Many closely held corporations—those owned by a few shareholders, often family members—require shareholders interested in selling their stock to offer it first to the corporation. (Shares the corporation itself owns are called treasury stock.) To maintain control over their ownership, many closely held corporations exercise this right, known as the right of first refusal.

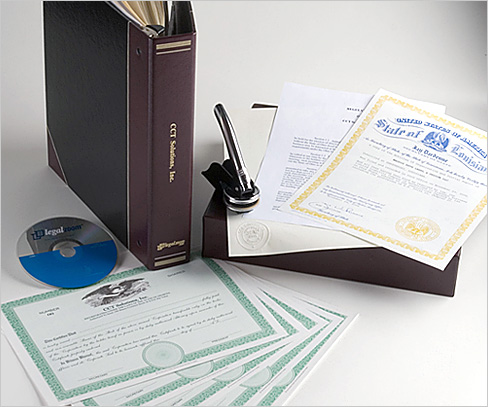

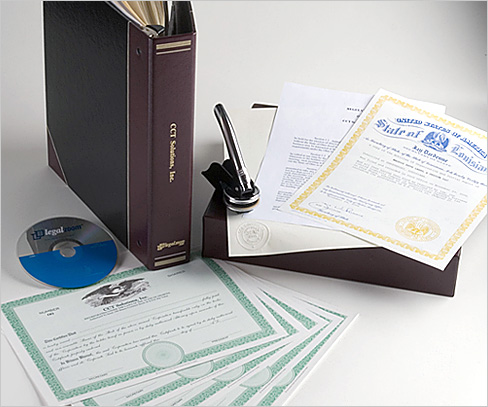

Once the secretary of state of the incorporating state has approved a request for incorporation and the corporation pays its fees, the approved articles of incorporation become its charter. With the charter in hand, the next order of business is to hold an organizational meeting for the stockholders to formally elect directors who in turn will appoint the corporate officers.